Dear Friends, Today’s blog post is aimed at educating everyone regarding NTPC share price target 2025, NTPC share price target 2030, NTPC share price trading view, NTPC share price nse, NTPC share price history, etc. The focus area of this post is to educate the readers and make them learn how to read the technical price action charts. Let us start.

NTPC

Before we learn about NTPC share price target 2025, we must look at the brief history of the company first. National Thermal Power Corporation popularly known as NTPC is a Central Public sector undertaking governed by the Ministry of Power. NTPC is into the generation & distribution of electricity to the Electricity boards of the States. It is also into the exploration of Natural Gas. NTPC also undertakes projects on construction, engineering, power plant management, etc. NTPC was established in the month of November 1975 by the then Prime Minister of India, Mrs Indira Gandhi.

The company’s first thermal power project was at Shaktinagar, Uttar Pradesh. NTPC has more than 15000 employees on their payroll. NTPC operates in two locations in Bangladesh, one in Sri Lanka, and from 70 locations in India. The company has a power generation capacity of more than 62000 MW and it aims to double this capacity by the year 2032. The company will also be undertaking a 500MW power generation project in Sri Lanka. NTPC is also in talks with the Nigerian government for setting up Power generation plants in Nigeria. Readers who wish to learn more about NTPC, pls click here.

Table of Contents

Technical Analysis – NTPC share price

The technical chart below is the monthly price action chart of NTPC. NTPC was listed on the Indian exchanges, the National Stock Exchange and the Bombay Stock Exchange, on 5th November 2004. This chart shows the price action in NTPC in a monthly time frame since its listing year. The listing issue price for investors was set at Rs 62 per share and it closed at the price of Rs 75.55 on the same day.

Before we proceed to decipher the technical price action chart, a few points should be kept in mind. The horizontal arrows are pointing at the price highs and the breakout candles. The upward arrows are the areas where the price action is finding support in the charts. The green circles represent the all-time high price points in the chart. NTPC share price resistance line is drawn at the level of 73.15. This level was crossed in the third-month post-listing of NTPC shares on the Indian exchanges. The price moved further up with little consolidation and reached the level of 120.75. The price did not sustain at that level and it came crashing down within two months of this high.

As you can see, the price touched the level of 73.15 and bounced back. This means there is strong support for the price in that area. The price action again started moving upwards and retested the previous high of 120.75 within six months of the fall. This was in the year 2007. As you can see in the chart, the price action continued till the start of the year 2008 and reached a level of 242.3 This is more than 100% returns by the NTPC share price within a year. The year 2008 saw a crash in the world markets thanks to the Lehman brothers. The company defaulted and the stock markets across the world crashed.

The price of NTPC also crashed along with the markets and reached a low near Rs 90. Post this global crash. the markets started to recover and so did NTPC share price. The rebound from the recent lows saw the price jump to a high of Rs 210.1 within 14 months of the crash. This is also highlighted in the chart above. This short period up move couldn’t sustain much longer and the prices again started to slump to lower levels. During this slump, the prices again retested the previous lows of nearly Rs 90, which now acted as a support line for the price action.

The price rebounded after testing these lows two times and reached a high of Rs 156.05 in the year 2022. The price broke out of this range in the same year and started its upward journey towards the all-time high price. The resistance at the level of Rs 201.1 also was breached in the first quarter of the year 2023 and the price reached a new high by surpassing the previous high of Rs 242.3. Now the price is sustaining within the range of Rs 201.1 & Rs 242.3. Once it surpasses the level of Rs 242.3 again, the price will be in unchartered territory towards a new lifetime high.

I hope readers enjoyed & learned to analyse the decode the price action charts as explained above. Readers who wish to view charts of shares they are holding may visit websites like Chartink, Tradingview, etc. for more learning.

NTPC share price target 2025 to 2030

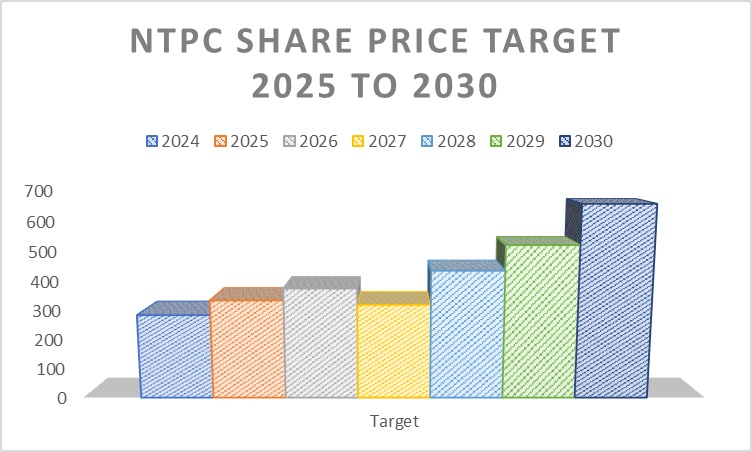

The above paragraphs decoding the price action should be read by a learner again and again to understand the price movement of shares in the stock market. The bar graph below shows the NTPC share price targets that may be achieved in the coming years. NTPC share price nse is expected to reach the target of Rs 655 by the year 2030. The price is expected to cool off between the year 2025 to 2026. It may again start the up move and reach Rs 435 by the year 2028. Please note that these targets are not fixed and may be achieved.

These are derived based on our understanding of the charts and fundamentals of the company through our experience in the market. The 52-week high and low of NTPC share price are Rs 252 & Rs 161 respectively.

NTPC shareholding pattern

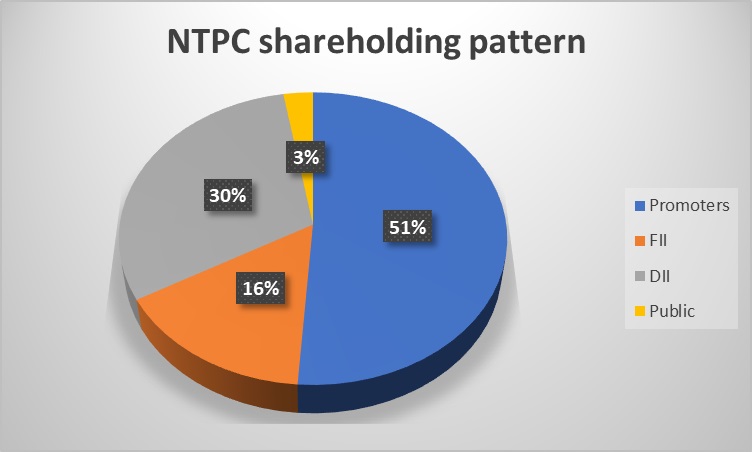

The pie chart below represents the current NTPC shareholding pattern. The promoters hold a 51.1% stake in the company, FIIs at 15.6%, DIIs at 30.51% and the public holds a 2.69% stake in the company. The FIIs stake has increased from 11.94% in the year 2021 to 15.6% in 2023. The DIIs stake has reduced from 33.93% to 30.51% within the same time period. There is no significant change in the public shareholding.

Fundamentals – NTPC

The company currently commands a market cap of more than Rs 2.30lac crores with a price-to-earnings ratio of 12. The current book value of the stock is Rs 158. NTPC has delivered a healthy ROCE and ROE of 9.8% & 12% respectively. The company has a dividend yield of 3%. The debtor days of NTPC have improved from 78 to 59 currently. The main competitors of NTPC are Adani Power, Tata Power, Adani Green, Power Grid Corporation, etc.

NTPC has registered a revenue of Rs 1.76lac crores in the fiscal year ending March 2023. NTPC net profit stood at more than Rs 17000 crores. The company has delivered an outstanding stock price CAGR of 38% over the last 3 years. With a strong balance sheet, we believe the company is going to outperform its competitors and maintain the number 1 position in the market.

What is NTPC share price target 2025?

The share price of NTPC may reach Rs 335 by the year 2025.

What is NTPC share price target 2027?

NTPC share price may reach Rs 320 by the year 2027.

What is NTPC share price target 2030?

NTPC share price target for the year 2030 is Rs 655.

Where can we check NTPC share price history?

Readers may check NTPC share price history on the websites like moneycontrol, nseindia, etc.

How to check the current NTPC share price?

Readers may check the current NTPC share price on websites like nseindia, tradingview, etc.

How much is NTPC share price dividend?

NTPC share price dividend yield is 3%.

Disclaimer

The above blog post is only for learning and educational purposes. It is in no way a recommendation to buy or sell shares. The chart reading, targets, etc. in the above paragraphs are based on our decade-long experience in the markets. Readers are advised to consult their financial advisors before making any decision related to investment. The investments in the market are subject to market risks. Also please note that we are not SEBI-registered analysts. Readers who wish to learn more, please check the links below:

- Tata Motors share price target 2025

- NMDC steel share price target 2025

- Suzlon share price target 2025

- BPCL share price target 2025

- IEX share price target 2025

- Yes bank share price target 2025

- Infosys share price target 2025

- TCS share price target 2025

- Titan share price target 2025

- Kritika wires share price target 2025