Dear Friends, in today’s blog post we will be learning about one of India’s iconic automobile manufacturers: Maruti Suzuki. Also, we will be touching on the fundamental as well as technical aspects of Maruti Suzuki’s share price target 2025 to 2030.

About the company

Maruti Suzuki, earlier known as Maruti Udyog Limited, was founded in the year 1981 – 42 years ago. Maruti Suzuki is known for manufacturing low-cost maintenance cars for the Indian Market. The first manufacturing unit of the company opened in Gurugram(then known as Gurgaon), Haryana.

The most loved vehicles of Maruti Suzuki are the Maruti 800, Maruti Zen, Omni van, Esteem, Wagon R, Versa, Alto, and Ciaz, to name a few.

Maruti is a household name in India with almost every home having an automobile had an experience with Maruti Suzuki automobiles.

To read more about Maruti, pls click here.

Table of Contents

Fundamentals of Maruti Suzuki share price

Let’s dig into the fundamental analysis of Maruti Suzuki.

Maruti Suzuki is a debt-free company and has a market share of nearly 40%. The company has enjoyed a near monopoly in the Indian market in the initial years and has gained the complete trust of the Indian consumer with its value-for-money products and services.

Almost every household and every neighborhood can boast of possessing/having experienced an automobile manufactured by Maruti Suzuki.

The promoter holding of Maruti Suzuki shares is almost constant near 56.3%. DIIs holding has increased from 15% in March 2021 to 18.5% in March 2023.

FIIs holding has dropped from 23% in March 2021 to 21 % in March 2023.

Public holding of the company’s shares has also decreased from 5.4% in March’2021 to 3.7% in March’2023.

| Shareholding | Mar-21 | Mar-22 | Mar-23 |

| Promoters | 56.30% | 56.30% | 56.45% |

| FII | 23.10% | 22.50% | 21.10% |

| DII | 15.00% | 16.20% | 18.50% |

| Public | 5.40% | 4.80% | 3.70% |

The company has a market cap of Rs 324000 cr and price to equity ratio is 33.

Maruti Suzuki has delivered an ROCE of 14% and an ROE of 11%.

The book value of Maruti Suzuki share price is Rs 2046 and the stock is currently trading at 5.2 times the book value.

52-week high and low of Maruti Suzuki share price is Rs 10812 and Rs 8076 respectively.

Maruti Suzuki has delivered a CAGR (Compound Annual Growth Rate) of 18% in the past decade and a CAGR of 20% over the last five years.

Profit & Loss

| P&L | Mar-17 | Mar-19 | Mar-21 | Mar-23 |

| Sales (in cr) | 68085 | 86068 | 70372 | 117571 |

| Expenses (in cr) | 57664 | 75012 | 64961 | 106542 |

| Net Profit (in cr) | 7511 | 7651 | 4389 | 8211 |

The sales of the company have increased by 67% over the last two years and the net profit has also increased by 87% during the same time period.

Technical Analysis of Maruti Suzuki share price

Let’s take a look at the technical charts of Maruti Suzuki share price movement over a period of time through various charts.

A short-term trader should look at a shorter time frame, a medium-term trader should look at a mid-term time period and a long-term investor should invest by studying the long-term charts.

Daily chart of Maruti Suzuki share price movement

The high of Rs 9329.8 on 14th May’23 was broken on the upward side on 25th May’23 when the stock closed at Rs 9399.95. The subsequent low of Rs8960.55 can be taken into consideration as the stop loss and entry can be taken in the stock price.

Since that day, the share price has not touched the stop loss level and has reached a new high of Rs 10810.85 on 16th Oct’23.

So with a risk of Rs 439.4 the return has been Rs 1410.9 which is a risk-reward ratio of 1:3. It’s a very good return of 15% given by the Maruti Suzuki share price in such a short period of time.

Now, let’s look at the monthly chart of Maruti Suzuki share price:

The Maruti Suzuki India ltd. share price has been respecting the moving average (21) and has seldom moved below it with Covid-19 and the 2018 market crash being the exceptions.

So for a long-term investor, the monthly chart provides a crystal clear picture as to where he/she should park his money and avoid daily noises to reap big gains over a period of time.

The market always provides an opportunity for investing at lower levels, in this case, it was during COVID-19, when the Maruti Suzuki share price touched a low of approximately Rs 4000. Since then the price has not looked back and increased by 2.5 times over the last three years.

So if an investor had invested Rs 100000 in Maruti Suzuki share price during the Covid market crash, the same would be now Rs 2.70 lacs, which is a whopping gain of 170% during the last three years.

Maruti Suzuki share price target 2025 to 2030

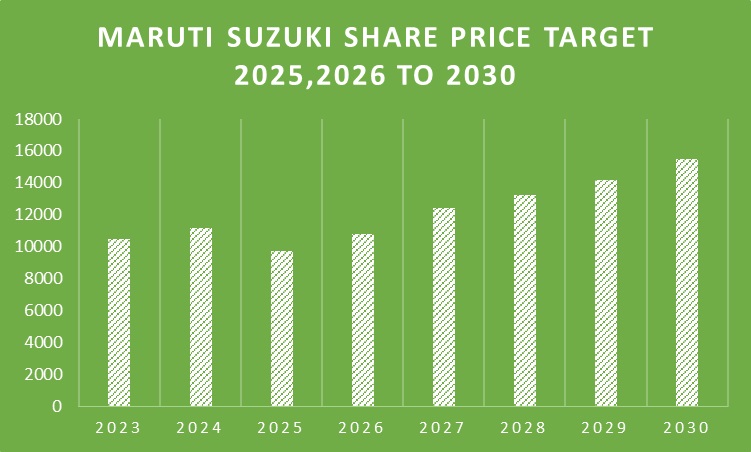

Maruti Suzuki India ltd share price is expected to be in between Rs 10500 and Rs 11200 in the year 2024.

Maruti Suzuki share price may be around Rs 9720 in the year 2025 as the stock may see some correction and profit booking before the next upward movement.

Maruti Suzuki share price target 2030 is Rs 15500.

Does Maruti Suzuki pay dividends to its shareholders?

Yes, Maruti Suzuki pays dividends to its shareholders.

Is Maruti Suzuki a debt-free company?

Yes, Maruti Suzuki is almost a debt-free company.

What is Maruti Suzuki share price target 2025?

The share price target in the year 2025 is Rs 9720.

What is Maruti Suzuki share price target 2026?

The target for the share price of Maruti Suzuki in the year 2026 is Rs 10800.

What is Maruti Suzuki share price target 2030?

The share price target for Maruti Suzuki for the year 2030 is Rs 15500.

What is Maruti Suzuki share price target today?

Maruti Suzuki share price today can be checked on websites like tradingview.com, moneycontrol.com, etc.

How to check Maruti Suzuki share price target tomorrow?

Maruti Suziki share price target tomorrow can be speculated by looking at various factors like charts, option chains, etc.

What was Maruti Suzuki share price in1990?

Previous year’s share price of Maruti Suzuki can be checked from websites like tradingview.com, moneycontrol.com, etc.

Conclusion

The above blog post has been written with the aim of educating investors. It’s in no way a buy or sell recommendation to anyone. We are not SEBI-registered analysts and the readers are advised to consult their financial advisors before making any investments. Readers willing to learn more please check the links below:

- M&M share price target 2025

- Tata Motors share price target 2025

- M&M share price target 2025

- Eicher Motors share price target 2025

- Yes bank share price target 2025

- IEX share price target 2025

- Titan share price target 2025

- Infosys share price target 2025

- BPCL share price target 2025

- ONGC share price target 2025