Dear Friends, today we will cover Eicher Motors share price target 2025, Eicher Motors share price target 2026, Eicher Motors share price target 2027, Eicher Motors share price nse target 2028, Eicher Motors share price target bse 2029, and Eicher Motors share price target 2030. This derivation of the target will be based on our fundamental as well as technical analysis expertise in the market.

Eicher Motors

Before we learn Eicher Motors share price target 2025, let us learn about the company first. Eicher Motors is into the manufacturing of commercial vehicles and two-wheelers. Eicher Motors owns the renowned & most loved two-wheeler brand – Royal Enfield. Eicher Motors was established in the year 1948 by Mr. Vikram Lal, and it started its operations with the distribution of tractors. Mr. Siddharth Lal is the current managing Director of Eicher Motors.

Eicher Motors manufactures commercial vehicles in collaboration with Volvo Group. The company also designs and markets commercial vehicles.

Royal Enfield is the iconic brand of Eicher Motors which has captured the imagination of the whole of India for the past many decades.

Table of Contents

Technical Analysis – Eicher Motors share price

Let us study the technical price action chart of the share price of Eicher Motors nse on the monthly time frame and learn from it.

The high of Eicher Motors in November 2012 is Rs 305. the breakout of this high came in the month of May 2013. The price did not look back even once after this breakout and reached a high of Rs 2162 in July 2015. This is more than 700% returns within two years.

The price consolidated for 11 months before the breakout in July 2016 with a high of Rs 2252. The price retested this breakout for a few months before rising again. Within 14 months, the price reached a high of Rs 3348 in September 2017. This is 50% returns within a year.

The price couldn’t sustain this level and started falling down through the downward channel movement, as shown in the chart. The price fell to the low of Rs 1245 in March 2020 during the COVID-19 crash. In July 2020 the price broke through the downward channel on the upside and started the move. The price then consolidated in the range of Rs 2162 & Rs 2980 for a few months.

The breakout of this range came in July 2022 and the price reached a high of Rs 3889.65 in November 2022. The price has retested the levels of Rs 2980 and Rs 3348 and is again moving up.

Readers are advised to study a lot of charts before they can identify the price action trends and make a decisive mood based on them. It will take at least two to three years of constant practice before one can identify the chart patterns and understand the price action to some extent.

Fundamental Analysis – Eicher Motors

Eicher Motors revenue has increased from Rs 10298 cr in the year 2022 to Rs 14442 cr in the year 2023. This is an increase of 65% year on year. The net profit of Eicher Motors grew by approximately 74% from the year 2022 to the year 2023. EPS(Earnings per share) has also increased from 61.3 to 106.5. This is an increase of 73.7% year on year.

| Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | |

| Revenue (in cr) | 9797 | 9154 | 8720 | 10298 | 14442 |

| Expenses (in cr) | 6893 | 6971 | 6937 | 8120 | 10996 |

| Operating profit (in cr) | 2904 | 2183 | 1783 | 2178 | 3446 |

| PBT(in cr) | 3297 | 2355 | 1798 | 2203 | 3800 |

| Tax % | 33% | 22% | 25% | 24% | 23% |

| Net Profit (in cr) | 2203 | 1827 | 1347 | 1677 | 2914 |

| EPS | 80.75 | 66.9 | 49.28 | 61.3 | 106.5 |

Eicher Motors is a debt-free company and has been maintaining a healthy dividend payout of nearly 34%. The compounded sales growth of the company for the last 10 years is 9% and the Eicher Motors share price has delivered a CAGR of 24% in the last decade.

The market cap of Eicher Motors is more than Rs 1lac crores at the current market price of Eicher Motors share at Rs 3729. The current book value of Eicher Motors shares is Rs 582. The company has delivered a ROCE and an ROE of 27.4% and 21% respectively. The inventory days currently are at 57 only. The 52-week high & low of Eicher Motors share price is Rs 3645 & Rs 2836 respectively.

Eicher Motors shareholding pattern

Eicher Motors shareholding pattern is shared in the below table. The promoter shareholding has been constant over the last three years at 49.2%. The FIIs shareholding has been around 29% during the same time period. The DIIs shareholding has increased in the last two years from 9.95% to 11.19%. Meanwhile, the public shareholding has decreased from 12.49% in the year 2021 to 10.87% in the year 2023.

| Shareholding | Mar-21 | Mar-22 | Mar-23 |

| Promoters | 49.23% | 49.20% | 49.20% |

| FII | 29.05% | 29.20% | 28.60% |

| DII | 9.08% | 9.95% | 11.19% |

| Public | 12.49% | 11.52% | 10.87% |

| Government | 0.15% | 0.10% | 0.10% |

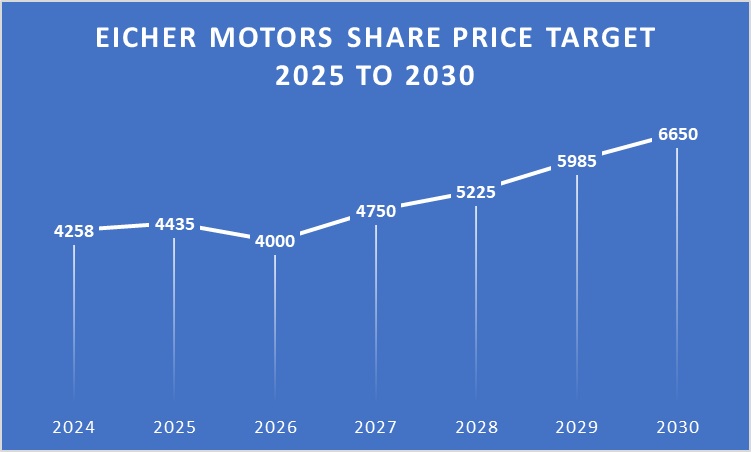

Eicher Motors share price target 2025 to 2030

The chart below shows the derived Eicher Motors share price target 2025 to 2030. These are based on our learnings in the decade-long market experience. The fundamental analysis is undertaken along with the study of Eicher Motors share price history to arrive at these targets. These are not fixed targets. These targets may or may not be achieved in these years. Readers are advised not to take this as an investment advice.

Eicher Motors share price target for the year 2024 is Rs 4258. The price is expected to be in between the range of 3820 & 4520.

The share price target of Eicher Motors for the year 2026 is Rs 4000. The price is expected to consolidate and remain sideways during this period.

Eicher Motors share price target 2030 is expected to be Rs 6650 and Eicher Motors share price target 2040 is expected to be above Rs 11000.

| Year | Low | High | Target |

| 2024 | 3820 | 4520 | 4258 |

| 2025 | 3985 | 4685 | 4435 |

| 2026 | 4110 | 4450 | 4000 |

| 2027 | 4420 | 5050 | 4750 |

| 2028 | 4590 | 5750 | 5225 |

| 2029 | 4860 | 6450 | 5985 |

| 2030 | 5710 | 6950 | 6650 |

The above range and targets are not a piece of investment advice.

Eicher Motors share price history

The table below contains the data of the 52-week OHLC(Open, High, Low, Close) of Eicher Motors share price.

| Date | OPEN | HIGH | LOW | close |

| 01-Nov-23 | 3,309.80 | 3,315.10 | 3,275.00 | 3,282.25 |

| 31-Oct-23 | 3,366.55 | 3,367.00 | 3,287.20 | 3,295.55 |

| 03-Oct-23 | 3,426.90 | 3,434.95 | 3,302.90 | 3,351.40 |

| 29-Sep-23 | 3,444.95 | 3,480.50 | 3,426.30 | 3,446.95 |

| 01-Sep-23 | 3,350.00 | 3,406.45 | 3,322.10 | 3,400.40 |

| 31-Aug-23 | 3,410.00 | 3,410.00 | 3,322.00 | 3,336.60 |

| 01-Aug-23 | 3,375.00 | 3,435.00 | 3,367.05 | 3,415.90 |

| 31-Jul-23 | 3,350.00 | 3,375.95 | 3,318.45 | 3,365.50 |

| 03-Jul-23 | 3,590.95 | 3,666.00 | 3,585.55 | 3,630.85 |

| 30-Jun-23 | 3,540.10 | 3,600.00 | 3,505.30 | 3,580.10 |

| 01-Jun-23 | 3,713.70 | 3,733.00 | 3,687.00 | 3,716.05 |

| 31-May-23 | 3,678.35 | 3,727.00 | 3,656.25 | 3,671.95 |

| 02-May-23 | 3,326.95 | 3,383.80 | 3,325.00 | 3,356.15 |

| 28-Apr-23 | 3,275.00 | 3,305.00 | 3,265.35 | 3,301.10 |

| 03-Apr-23 | 3,050.00 | 3,050.00 | 2,981.10 | 3,004.30 |

| 31-Mar-23 | 2,923.10 | 2,963.35 | 2,921.00 | 2,948.85 |

| 01-Mar-23 | 3,106.00 | 3,143.90 | 3,086.70 | 3,138.80 |

| 28-Feb-23 | 3,132.00 | 3,181.00 | 3,091.15 | 3,105.90 |

| 01-Feb-23 | 3,280.00 | 3,354.95 | 3,240.00 | 3,303.10 |

| 31-Jan-23 | 3,201.05 | 3,277.00 | 3,177.00 | 3,263.35 |

| 02-Jan-23 | 3,227.00 | 3,249.95 | 3,203.30 | 3,228.85 |

| 30-Dec-22 | 3,290.00 | 3,298.00 | 3,217.25 | 3,227.75 |

| 01-Dec-22 | 3,489.60 | 3,500.00 | 3,430.00 | 3,437.45 |

| 30-Nov-22 | 3,419.80 | 3,504.50 | 3,417.05 | 3,484.50 |

Eicher Motors share dividend history

The table below contains Eicher Motors dividend history. As you can see, the company has been consistent in delivering dividends to its proud shareholders.

| Dividend Year | Dividend Type | Dividend amount per share (in Rs.) | Dividend (%) |

| 2022-23 | Final | 37 | 3700 |

| 2021-22 | Final | 21 | 2100 |

| 2020-21 | Final | 17 | 1700 |

| 2019-20 | Interim | 125 | 1250 |

| 2018-19 | Final | 125 | 1250 |

| 2017-18 | Final | 110 | 1100 |

| 2016-17 | Final | 100 | 1000 |

| 2015-16 | Interim | 100 | 1000 |

| 2014 | Final | 50 | 500 |

| 2013 | Final | 30 | 300 |

| 2012 | Final | 20 | 200 |

| 2011 | Final | 16 | 160 |

| 2010 | Final | 11 | 110 |

| 2009 | Final | 7 | 70 |

| 2008 | Final | 5 | 50 |

| 2007-08 | Final | 5 | 50 |

| 2006-07 | Interim | 29 | 290 |

| 2005-06 | Final | 4 | 40 |

| 2004-05 | Final | 4 | 40 |

| 2003-04 | Final | 3.5 | 35 |

| 2002-03 | Final | 3.5 | 35 |

| 2001-02 | Final | 2.5 | 25 |

What is Eicher Motors share price dividend history?

The dividend history of Eicher Motors is covered in this blog post. Readers can check it out above.

Where can I check Eicher Motors share price live chart?

Readers can check Eicher Motors share price live chart at the website tradingview.

What is Eicher Motors share price target 2025?

Eicher Motors share price target 2025 may be Rs 4435.

What is Eicher Motors share price target 2028?

The expected target of Eicher Motors for the year 2028 is Rs 5225.

What is Eicher Motors share price target 2030?

Eicher Motors share price target 2030 may be Rs 6650.

How can I check Eicher Motors share price target tomorrow?

Eicher Motors share price target tomorrow can be speculated based on the historical price action, vwap, options chain, chart, etc. It depends on many factors. Readers need a lot of study to arrive at the same.

How can I check Eicher Motors share price today?

Eicher Motors share price today can be checked on the websites like moneycontrol, nseindia, etc.

What is Eicher Motors share price history?

Eicher Motors share price history for the last 52 weeks is shared in this blog post. For more data, please visit tradingview, nseindia, etc.

Disclaimer

Readers are advised to take this blog as an educational post only. This is written to make readers aware of the market parameters and is in no way investment advice to anyone. Readers should not take this as an investment decision-making blog. We are not SEBI-registered analysts and the readers must consult their financial advisors before making any decision on investment. The investments are subject to market risks. Readers who wish to learn about Hero Motocorp share price target 2025, Maruti Suzuki share price target 2025, Tata Motors share price target 2025, M&M share price target 2025, Yes bank share price target 2025pls click here.