BPCL share price target is derived by studying the company, the technical and fundamental figures, etc. Bharat Petroleum Corporation Limited, popularly known as BPCL, is an Indian PSU (Public Sector Undertaking). The company is owned by the Ministry of Oil & Natural Gas under the Government of India. It was earlier known as Ragoon Oil & Exploration Company. The well-known subsidiaries of BPCL are IGL(Indraprastha Gas Limited) & Petronet LNG. The main refineries operated by BPCL are Bina Refinery, Kochi Refinery, and Mumbai Refinery. The Indian Government has approved the privatization of BPCL and the stake sale is pending as of now.

Table of Contents

Fundamental study – BPCL

BPCL has a market capitalisation of more than Ra 83k crores with the current share price at Rs 383. The price-to-earnings ratio is at 2.85. The book value of the stock is at Rs 327. The stock is currently trading at 1.17 times its book value. BPCL has delivered a ROCE of 6.85% and an ROE of 6.32%. The company has more than 14% of the country’s total refining capacity. BPCL owns more than 20000 retail outlets across the country for distribution of its petroleum products. It also distributes LPG (Liquid Petroleum Gas) through a wide network of more than 6000 distributors across India.

They serve more than 9 crore customers and command a market share of more than 26%. BPCL also supplies aviation fuel to various airports. BPCL is also in the supply of Lubricants and LNG(Liquid Natural Gas). The competitors of BPCL are Reliance Industries, IOCL, HPCL, MRPL, CPCL, etc. The revenues of BPCL in FY 2023 are Rs 4.73 lac crores and the net profit earned is Rs 2131 cr. The promoters hold 52.98% of BPCL shares and the shareholding of FIIs & DIIs is 12.57% & 22.59% respectively. The public shareholding in BPCL is at 10.61% at the end of March 2023.

BPCL share price history

The below table shows the OHLC(Open, High, Low, Close) prices. The time frame here is monthly.

| Date | OPEN | HIGH | LOW | close |

| 31-Oct-23 | 348.35 | 353.95 | 344.65 | 349.25 |

| 03-Oct-23 | 348.5 | 349.2 | 340.85 | 341.35 |

| 29-Sep-23 | 345.75 | 348.15 | 345 | 346.6 |

| 01-Sep-23 | 341.05 | 344.9 | 340.55 | 344.2 |

| 31-Aug-23 | 351 | 352 | 339.1 | 340.55 |

| 01-Aug-23 | 377.5 | 379.8 | 374.25 | 377.5 |

| 31-Jul-23 | 373.7 | 378.45 | 371.65 | 377.5 |

| 03-Jul-23 | 365.2 | 379.95 | 363.4 | 375.3 |

| 30-Jun-23 | 365.85 | 368.8 | 361.25 | 364.7 |

| 01-Jun-23 | 365.3 | 368.9 | 364.1 | 364.55 |

| 31-May-23 | 360.4 | 366.45 | 360.2 | 363.5 |

| 02-May-23 | 358.3 | 364.9 | 358 | 361.1 |

| 28-Apr-23 | 356 | 358.3 | 352.45 | 357.6 |

| 03-Apr-23 | 338 | 338 | 329.15 | 329.95 |

| 31-Mar-23 | 344.9 | 346.4 | 340.95 | 344.3 |

| 01-Mar-23 | 316.8 | 321 | 315.55 | 315.9 |

| 28-Feb-23 | 317.15 | 321.65 | 314.05 | 317.35 |

| 01-Feb-23 | 343.25 | 344.7 | 330 | 334.7 |

| 31-Jan-23 | 342.95 | 351.5 | 341.25 | 343.25 |

| 02-Jan-23 | 330.05 | 334.7 | 327.55 | 333.85 |

| 30-Dec-22 | 328 | 333 | 327.55 | 330.5 |

| 01-Dec-22 | 342 | 343.75 | 337.05 | 338.6 |

| 30-Nov-22 | 339.05 | 343.75 | 335.8 | 341.15 |

Technical Analysis – BPCL share price

The technical analysis of BPCL share price will be undertaken by trying to decode the monthly price action chart of BPCL. The chart is pasted below. Let’s begin.

The upward arrows (Black in color) represent the support zones, the Orange sideways arrows point at the breakout candles, and the green square is at an all-time high price. As you can see, the first sideways arrow is at a high of Rs 92.8, which will be the opening reference point. The share price is in a sideways trend. The breakout of this level came after 21 months and is pointed by the second orange candle. The breakout is there but post this breakout, the high reached Rs 140 and it went in a sideways trend. This sideways trend is a long one lasting more than 4 years, i.e., from 2010 to 2014.

The breakout of the level of 140 in March 2014, as shown in the chart, makes the price move upwards. As you can see, the price starts moving up in an upward channel (highlighted in the above picture). This is to note that the channel starts forming after a few movements in the price, you can’t gauge the channel upfront. Once the upward channel starts forming, you may draw it and observe the price movement. The price needs to close above or below the channel to make the decisive move. The all-time high of stock was achieved here in the month of October 2017.

In the year 2018, the price finally gave way and broke down this channel. Since the channel got broken, it started sliding down and made a low, represented by the black arrow. The price took support from this zone, represented by the yellow lines. The price started moving upwards and again tested the all-time high zone. Again this BPCL share price slid downwards and retested the support zone and moved upwards. It made a high high and again slid back down to the support zone.

The trend line, as shown in the picture, is drawn by joining the two high highs. The third high has retested this trendline two times and is currently at this level. The price, if breaks this trendline upwards, will lead it to the all-time high zone. Readers need to observe a lot of charts before identifying such trends becomes easier. A lot of practice and patience are required in the markets to learn and earn in the long run.

BPCL share price target 2025 to 2030

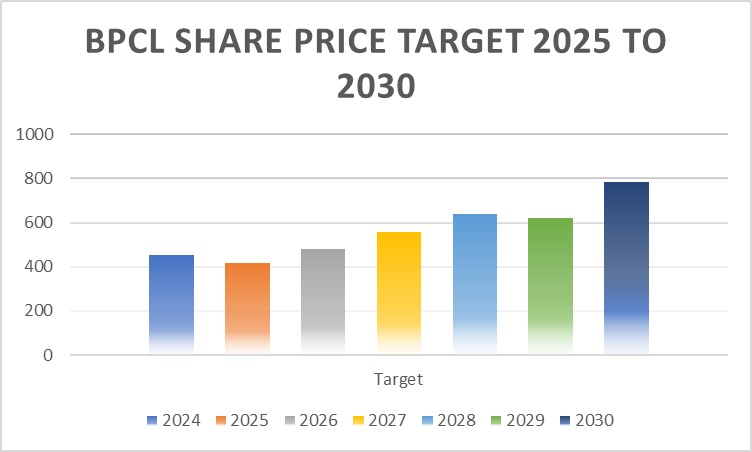

The share price of BPCL for the upcoming years can be speculated from our decade-long experience in technical and fundamental analysis. The below bar chart is based on the derived targets. These may or may not be achieved by BPCL share price in the long run. So, readers are requested not to take these targets as final. You may consult your financial advisor before making any decision.

BPCL share price may reach Rs 480 by the year 2026 and Rs 640 by 2028.

What is BPCL share price target 2025?

BPCL share price may reach Rs 415 by the year 2025.

What is BPCL share price target tomorrow?

BPCL share price target tomorrow can be speculated by checking various things like options chain analysis, technical chart, today’s price movement, etc. You can check these parameters on the websites like nseindia, tradingview, etc.

What is BPCL share price target 2030?

The share price of BPCL is expected to reach Rs 785 by 2030.

How to check BPCL share price dividend?

The dividend yield of BPCL is 1.04%. You can check the dividend history of BPCL on websites like moneycontrol.

How to check BPCL share price history?

BPCL share price history can be checked on the websites like nseindia, chartink (for charts), moneycontrol, etc. We have also shared the 52-week OHLC prices of BPCL above. You can check there also.

What is BPCL share price nse live?

You can check BPCL share price nse live on the website nseindia.

Disclaimer

The above blog post is meant only to educate the readers. The readers need not make any decision based on this blog post. Investments are subject to market risks and the readers are advised to consult their financial advisors before making any decision on investment in BPCL. We are not SEBI-registered analysts. Readers who wish to learn more please check the links below:

- NTPC share price target 2025

- Tata Motors share price target 2025

- ONGC share price target 2025

- ITC share price target 2025

- IEX share price target 2025

- Adani Power share price target 2025

- Adani ports share price target 2025

- Tata Power share price target 2025

- Titan share price target 2025

- Yes bank share price target 2025