Adani Power share price target 2024, 2025 till 2030: Dear Friends, once again I welcome you back. Many investors and traders these days are wary about Adani’s power share price target. The uncertainty gripping the Adani group since March 2023 post-Heidenburg’s report is understandable.

In today’s blog post, we will share fundamental and technical aspects of Adani Power. This will help you all to make an informed decision regarding the future prospects of the company.

Adani Power

Adani Power is in the power generation sector. Adani Power was incorporated when Adani Group ventured into the power sector in the year 2006.

It is part of the Adani group.

The company has become a leader in power generation and is the largest private power producer in India.

The company registered the world’s number 1 coal-based supercritical thermal power project under the clean development mechanism of the Kyoto Protocol.

The company has overcome so many obstacles to become a leader through perseverance, prudence, and patience.

The company has power plants located in the following locations:

Two each in Gujarat & Chattisgarh, One each in Maharashtra, Rajasthan, Jharkhand, and Karnataka, and one is upcoming in Madhya Pradesh.

The company boasts of a power generation capacity of more than 13500 MW, employing more than 2700 employees.

The company sold more than 52.1 billion units in FY22.

Board of Directors of Adani Power

- Mr. Gautam Adani – Chairman

- Mr. Rajesh Adani – Director

- Mr. Anil Sardana – Managing director

Independent & Non-executive directors- Ms. Chandra Iyengar, Mr. Mukesh Shah & Mr. Sushil Kumar Roongta.

You can read more about the company by clicking on the link www.adanipower.com

Adani Power share price fundamental analysis

Let us look at the fundamental analysis of Adani’s power

| Market cap (in cr) | P/E | current price (in Rs) | Book value (in Rs) | ROE | ROCE |

| 128764 | 8.76 | 334 | 76.8 | 44.00% | 15.00% |

The market cap of Adani Power is approximately Rs 128764cr and the current book value is 76.8. The stock is currently trading at 4.3 times the book value.

The company has delivered a robust ROCE of 15% and ROE of 44% respectively over a period of time.

| Profit & Loss | Mar-19 | Mar-21 | Mar-23 |

| Sales (in cr) | 23884 | 26221 | 38773 |

| Expenses (in cr) | 18901 | 17533 | 28677 |

| Net Profit (in cr) | -984 | 1270 | 10727 |

| EPS | -2.5 | 3.25 | 27.8 |

The sales of Adani power have increased by more than 44% since March’2021 and the Net profit has increased by more than 744%. EPS has also seen a jump of 755% during this period.

Adani Power’s shareholding pattern

The table below contains the shareholding pattern of Adani Power

| Shareholding | Jun-19 | Jun-21 | Jun-23 |

| Promoters | 74.97% | 74.97% | 74.97% |

| FII | 11.54% | 12.56% | 11.95% |

| DII | 5.50% | 5.00% | 0.04% |

| Public | 7.96% | 7.47% | 13.04% |

During the last two years, the promoter holding and FII holding have remained stable in the company. DII holdings have reduced to almost nil whereas the public holding of Adani power shared has increased by 74.5%.

Table of Contents

Adani Power share price technical chart analysis

Let’s look at the weekly and monthly charts of Adani power share price movements over the last 2 years and 5 years respectively.

Weekly Chart

The high of Feb’22 was Rs 131.8 which was broken in the month of April’22 when the stock closed at a price of Rs 143.2. The stock then rose to an all-time high price of Rs 432.5 in Sep’22.

Adani Power share prices got rocked after the Hindenburg report which led to a crash in the market. The stock crashed from Rs 432.5 to a low of Rs 132.4 in March’23.

The Adani group refuted all claims by Hindenburg and none of the charges have been proven in court till now.

The share price of Adani Power again started moving upwards and gave a breakout above Rs 286 in August’23. The stock is slowly moving towards its all-time high price.

Monthly Chart of Adani Power Share Price

Adani Power share price reached a high of Rs 185.1 in March’22. After the breakout of this, the all-time high price of Rs 432.5 was attained in Sep’22. As you can see in the above chart, the price movement takes support from the 21 moving average and reverses.

Now the stock has again turned upwards after the recent fall and is moving towards its all-time high price.

If you compare the weekly and monthly charts of Adani’s share price, you can see less noise in the larger time frame(monthly) as compared to the shorter time frame (weekly chart).

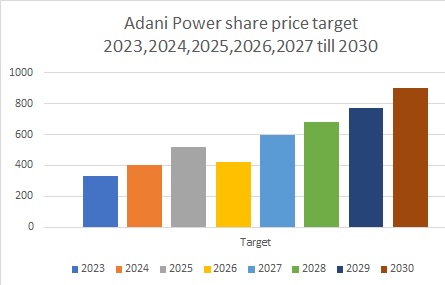

Adani Power share price target

The following table depicts the projection of Adani power share price. The price is expected to reach Rs 900 by the year 2030.

| Year | Target |

| 2023 | 334 |

| 2024 | 400 |

| 2025 | 520 |

| 2026 | 420 |

| 2027 | 600 |

| 2028 | 680 |

| 2029 | 775 |

| 2030 | 900 |

How to buy Adani power shares?

You must have a Demat account to buy Adani power shares.

Which are the leading brokerages offering a demat account?

Many known brokerages offering a demat account are Hdfc, Kotak, Upstox, Motilal Oswal, Icici, etc.

What will be ADANI POWER share price in 2023?

ADANI POWER’s share price in 2023 is Rs 334.

What will be ADANI POWER share price in 2024?

Adani Power’s share price in 2024 is expected to reach Rs 400.

What will be ADANI POWER share price target in 2025?

ADANI POWER’s share price is expected to touch Rs 520 by the year 2025.

What will be ADANI POWER’s share price target in 2026?

ADANI POWER’s share price in 2026 may be around Rs 420

What will be ADANI POWER share price target in 2027?

ADANI POWER’s share price in 2027 is expected to be Rs600.

What will be ADANI POWER share price target in 2028?

ADANI POWER’s share price in 2028 may be Rs 680.

What will be ADANI POWER’s share price target in 2029?

ADANI POWER’s share price target for 2029 is Rs 775.

What will be ADANI POWER share price target in 2030?

ADANI POWER’s share price in 2030 is expected to be around Rs 900.

How to check Adani Power share price today?

It can be checked on many websites like nseindia.com, moneycontrol.com, etc.

What is Adani Power share price NSE?

This means the share price of Adani Power on the National Stock exchange.

Conclusion

The above blog post is regarding understanding the technical and fundamental parameters of ADANI POWER. The investor needs to look at all the pros and cons of investing.

This blog post shouldn’t be treated as a buy/sell recommendation for ADANI POWER shares.

One is advised to consult their respective financial advisors before investing their hard-earned money in the financial markets which are subject to risks. Readers willing to learn more please check the links below:

- Tata Motors share price target 2025

- ITC share price target 2025

- Kritika wires share price target 2025

- IRB Infra share price target 2025

- Suzlon share price target 2025

- Yes bank share price target 2025

- Axis bank share price target 2025

- SBI share price target 2025

- IRCTC share price target 2025

- Tata Power share price target 2025