Dear Friends, in today’s blog we will learn about Flair Writing share price target 2025 to 2030 through fundamental as well as technical analysis. The study is based on our decade-long experience in the share market. Let us learn about the company first.

Table of Contents

About Flair Writing

Before we learn about Flair Writing share price target 2025 to 2030, let us learn about the company and its operations. Flair Writing Industries Private Limited was incorporated in the year 1976 by Mr. Khubilal Jugraj Rathod. The company started with a range of metal pens and slowly expanded its business and products to many territories. The company operates in more than 97 countries and sells products through its distributors.

The well-known brands of the company are FLAIR, PIERRE CARDIAN, FLAIR CREATIVE, FLAIR HOUSEWARE, HAUSER, etc. Flair Writing Industries can roll out more than 2 billion pieces yearly.

The revenue of the company in the financial year 2023 was Rs 942 cr which is a jump of over 63.26% over the last financial year. The net profit earned by the company in FY23 was Rs 118 cr whereas the net profit earned in FY22 was only Rs 55cr. This is an increase of 114.5% in one year. The current market price of Flair Writing shares is Rs 368 and the market cap is Rs 3881 cr. The stock price to equity ratio is 32.9. The ROCE and ROE delivered by the company are 33.4% & 31.4% respectively.

| Mar-17 | Mar-18 | Mar-21 | Mar-22 | Mar-23 | |

| Revenue (in cr) | 419 | 573 | 298 | 577 | 942 |

| Expenses (in cr) | 333 | 478 | 275 | 480 | 758 |

| Operating profit (in cr) | 86 | 95 | 23 | 98 | 184 |

| PBT(in cr) | 69 | 69 | 2 | 73 | 159 |

| Net Profit (in cr) | 50 | 49 | 1 | 55 | 118 |

| Tax | 27% | 29% | 55% | 25% | 26% |

The debtor days have reduced from 100 to 67 days, which is a positive sign. Also, the company’s working capital requirement has reduced from 175 days to 117 days. The compounded profit growth of the company over the last 5 years is 19%. Readers who wish to learn more about the company may click on the website screener.

Flair Writing share price Technical Analysis

The chart below is the share price action of Flair Writing on a daily time frame. The IPO of Flair Writing had an offer price of Rs 288-304 . The shares are listed on the National Stock Exchange and Bombay Stock Exchange for Rs 450.9, which is a premium of 48% over the offer price.

Since then, the price has slid down and has corrected due to profit booking on the listing day. At present, the price is making a base or support and is in a consolidation phase. The prices are bound to bounce back in the near future given the potential of the company in the Indian market.

Flair Writing share price target

The line chart below shares the Flair Writing share price target 2025 to 2030. This is based on our decade-long experience and knowledge in the market.

Flair Writing share price target 2025 may be Rs 550 and the target of Flair Writing for the year 2030 may be Rs 825.

Flair Writing shareholding pattern

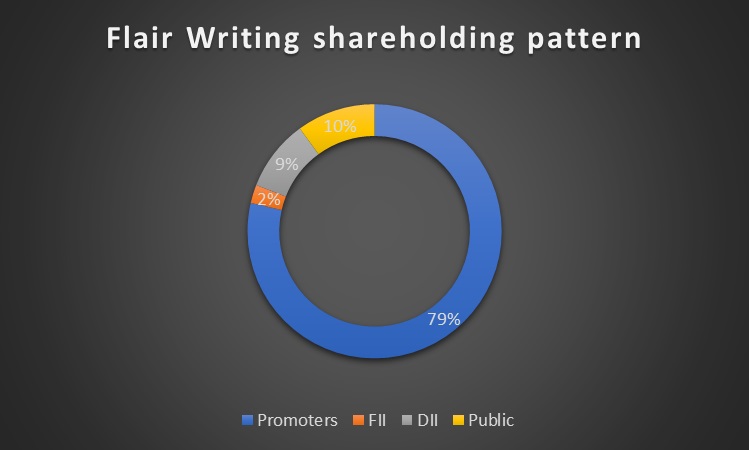

The pie chart below is the shareholding pattern of Flair Writing. The current promoter’s holding is at 78.59 %. FIIs and DIIs shareholding is at 2.34% and 9.07% respectively.

The public shareholding in Flair Writing is at 10%.

What is Flair Writing share price history?

Flair Writing shares were listed on the NSE and BSE on 1st Dec 23. There is hardly any history available for the shares of Flair Writing.

What is Flair Writing share price nse live?

Flair Writing share price nse live can be checked on the websites like moneycontrol, nseindia, etc.

What is Flair Writing share price target 2030?

The share price target of Flair Writing for the year 2030 may be Rs 825.

What is Flair Writing share price target 2025?

Flair Writing share price may reach Rs 550 by the year 2025.

Who are the competitors of Flair Writing?

The major competitors of Flair Writing are Kokuyo Camlin, Navneet Education, Linc, Repro India, etc.

Where can one check Flair Writing share price chart live?

You may check the share price chart nse live on websites like tradingview, chartink, etc.

Conclusion

The article and the Flair Writing share price target are based on our decade-long experience and limited knowledge of the market. The article is in no way an investment advice. Investors should speak to their financial advisors before making any decision regarding investment in the share market. We are not SEBI-registered analysts and readers should make due diligence before proceeding with money-related decisions. Investments in the market are subject to market risks. Readers who wish to learn more may check the links below:

- IEX share price target 2025.

- Tata Motors share price target 2025.

- Yes Bank share price target 2025.

- IREDA share price target 2025.

- Gandhar Oil share price target 2025.

- Kritika Wires share price target 2025.

- Dixon share price target 2025.

- Tata Power share price target 2025.

- Adani Ports share price target 2025.

- Adani Power share price target 2025.

- IDFC First bank share price target 2025.

- Kotak bank share price target 2025.