Dear Readers, today’s blog is aimed at Pidilite share price target 2025, Pidilite share price target 2030, Pidilite share price history, Pidilite share dividend, Pidilite industries share price today, etc. This will be covered through the technical and fundamental analysis of the company’s performance over the years and we will also learn more about the company. Let us begin.

About Pidilite Industries Ltd.

Before we derive Pidilite share price target 2025, let us learn about the company first. Pidilite Industries Limited is an Indian adhesive company. The company was founded in the year 1959 by Mr. Balvant Parekh and currently is headed by Mr. Bharat Puri as its Managing Director. The company is into the manufacturing of chemicals, adhesives, etc. Fevicol is the most loved and well-known brand of the company. The other well-known brands of the company are Fevikwik, M-seal, Dr.Fixit, Ranipal, etc.

Pidilite Industries Ltd. is headquartered in Andheri (East), Mumbai, Maharashtra. It has many manufacturing plants across India. The company employs more than 6000 people and is a household name in India. Readers who wish to know more about the company, pls click here.

Table of Contents

Fundamentals – Pidilite Industries Ltd.

Below is the Profit and loss statement of Pidilite Industries Ltd. for the last five years. The revenue of the company has increased by 18.93% over last year and was Rs 11799cr in FY 2023. The net profit of the company has increased by 6.79% during the same time period and was Rs 1289 cr. The market cap of the company is approximately Rs 1.27lac crores on the current share market price of Rs 2510.

The book value of the share price is Rs 148 and the shares of the company are trading at approximately 17 times the book value. The ROCE and ROE delivered by the company are 23.8% and 18.7% respectively. The company has delivered a Compound sales growth of 12% and the Pidilite Industries share price has delivered a CAGR of 24% during the last decade.

| Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | |

| Revenue (in cr) | 7078 | 7294 | 7293 | 9921 | 11799 |

| Expenses (in cr) | 5707 | 5718 | 5606 | 8065 | 9813 |

| Operating profit (in cr) | 1371 | 1576 | 1686 | 1856 | 1986 |

| PBT(in cr) | 1342 | 1470 | 1522 | 1614 | 1723 |

| Tax % | 31% | 24% | 26% | 25% | 25% |

| Net Profit (in cr) | 928 | 1122 | 1126 | 1207 | 1289 |

| EPS | 18.2 | 21.97 | 22.26 | 23.75 | 25 |

The current price-to-earnings ratio of the company is on the higher side at 84.5. Readers who wish to know more about the fundamentals of the company, pls visit screener.

Technical Analysis- Pidilite share price

The technical price action of Pidilite share price will be undertaken through the monthly share price chart. The technical price action chart on the monthly time frame is very simple looking and there is no noise in it whatsoever. It is one of the simplest charts you may find in this timeframe. The major price movements happen in the daily and weekly timeframe but ultimately the reader who cuts the noise and works on the monthly chart with all the bluechip companies is a happy lot.

Here you can see, the price action has respected the 20 ema line over and over again and this single indicator has stood the test of time in this case. The boxes represent the non-trending times on the chart before the price action again starts moving.

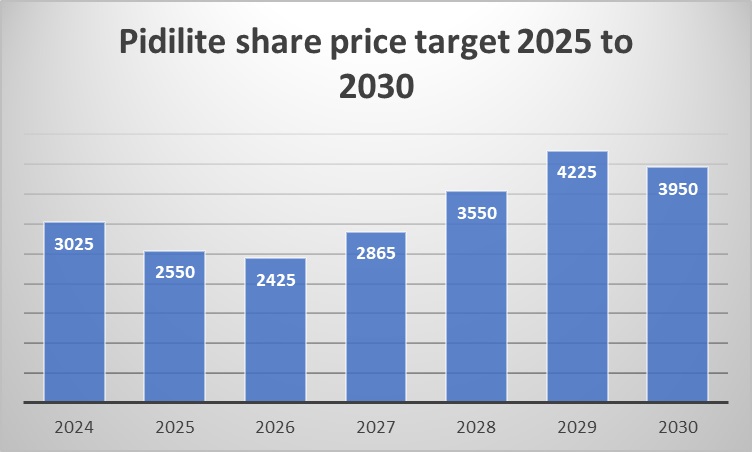

Pidilite share price target 2025 to 2030

Pidilite share price target 2025 may be Rs 2550 and may reach Rs 4225 by the year 2029. Pidilite share price target 2030 may reach Rs 3950 as it may consolidate for some time.

Pidilite share price target 2024 may be Rs 3025.

The share price target of Pidilite for the upcoming years is derived from our decade-long experience in the market. It is not a sure-shot target. It may or may not be achieved. Readers are not advised to invest according to these targets.

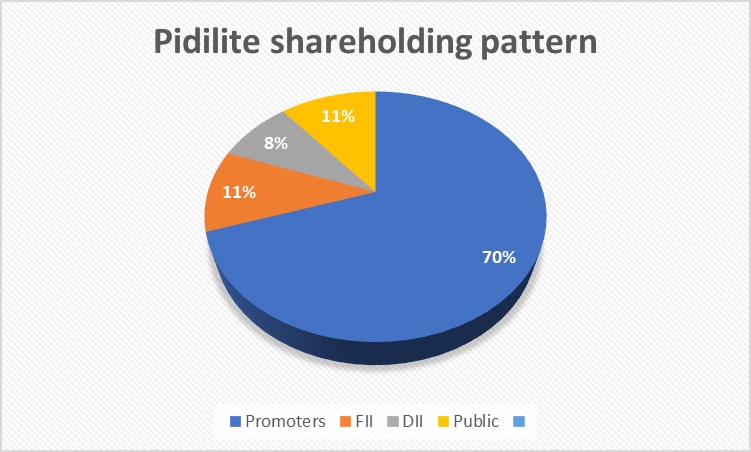

Pidilite shareholding pattern

The pie chart below represents the current shareholding pattern of Pidilite Industries Ltd. The promoters hold almost 70% of the stake in the company and the FIIs current holding is at 10.61%. The DIIs stake is at 8.45% and the public shareholding in the company is 10.98%.

Pidilite share price history

The table below shows the Open, High, Low, and Close prices of Pidilite Industries share price over the last 52 weeks on a monthly time frame. Readers can gauge the share price movement and study it in relation to the technical charts.

| Date | OPEN | HIGH | LOW | CLOSE |

| 01-Nov-23 | 2,452.00 | 2,465.00 | 2,401.65 | 2,406.35 |

| 31-Oct-23 | 2,364.00 | 2,478.00 | 2,350.35 | 2,458.00 |

| 03-Oct-23 | 2,439.50 | 2,447.90 | 2,412.55 | 2,425.40 |

| 29-Sep-23 | 2,440.00 | 2,452.40 | 2,429.00 | 2,439.50 |

| 01-Sep-23 | 2,524.95 | 2,533.55 | 2,486.10 | 2,498.25 |

| 31-Aug-23 | 2,581.00 | 2,584.85 | 2,494.95 | 2,515.00 |

| 01-Aug-23 | 2,615.00 | 2,640.80 | 2,602.05 | 2,634.80 |

| 31-Jul-23 | 2,615.85 | 2,626.85 | 2,590.20 | 2,614.95 |

| 03-Jul-23 | 2,599.20 | 2,613.55 | 2,570.00 | 2,571.45 |

| 30-Jun-23 | 2,602.10 | 2,645.90 | 2,585.30 | 2,597.10 |

| 01-Jun-23 | 2,618.00 | 2,669.00 | 2,614.05 | 2,651.55 |

| 31-May-23 | 2,600.05 | 2,618.70 | 2,592.10 | 2,607.85 |

| 02-May-23 | 2,429.00 | 2,431.00 | 2,406.00 | 2,419.75 |

| 28-Apr-23 | 2,395.05 | 2,422.50 | 2,376.00 | 2,419.25 |

| 03-Apr-23 | 2,350.00 | 2,350.00 | 2,296.30 | 2,327.60 |

| 31-Mar-23 | 2,324.95 | 2,368.00 | 2,313.00 | 2,353.00 |

| 01-Mar-23 | 2,312.35 | 2,316.25 | 2,295.20 | 2,307.50 |

| 28-Feb-23 | 2,277.00 | 2,313.60 | 2,266.70 | 2,300.80 |

| 01-Feb-23 | 2,291.50 | 2,333.00 | 2,270.00 | 2,315.30 |

| 31-Jan-23 | 2,303.90 | 2,304.90 | 2,275.25 | 2,279.55 |

| 02-Jan-23 | 2,555.00 | 2,560.00 | 2,510.00 | 2,530.00 |

| 30-Dec-22 | 2,610.00 | 2,610.00 | 2,541.30 | 2,550.15 |

| 01-Dec-22 | 2,752.55 | 2,766.00 | 2,727.00 | 2,733.55 |

| 30-Nov-22 | 2,736.05 | 2,787.50 | 2,704.65 | 2,748.70 |

To know more about the Pidilite Industries share price history, readers may visit the website nseindia.

What is Pidilite share price target 2025?

The share price target of Pidilite for the year 2025 may be Rs 2550.

What is Pidilite share price target 2030?

The share price target of Pidilite for the year 2030 is Rs 3950.

What is Pidilite share price history?

The 52-week share price history of Pidilite is shared above. Readers who wish to learn more about the same may visit moneycontrol.

What is Pidilite share price target tomorrow?

You may speculate on the target share price of Pidilite for tomorrow by checking the options chain, technical chart, etc.

What is Pidilite share price today?

You can check the share price of Pidilite today on the websites like nseindia, moneycontrol, etc.

Where can one find Pidilite share price nse live?

Readers can check Pidilite share price nse live on the websites like nseindia, moneycontrol, tradingview, etc.

What is Pidilite share price target 2027?

The share price of Pidilite may reach Rs 2867 by the year 2027.

What is Pidilite share price target 2050?

It is advised not to speculate on the share price of Pidilite so far from now. No one can accurately predict the target for the share price at that point in time. Anyone who is providing a target is just guessing.

Disclaimer

The above blog post is aimed at educating the readers about Pidilite Industries Ltd., Pidilite share price target 2025 to 2030, Pidilite Industries share price history, etc. This blog is not aimed to influence any decision-making of the readers on investment in Pidilite. We are not SEBI-registered analysts and the blog is written only for educational purposes. Readers are advised to speak to their investment advisors on their investment decisions. Readers who wish to learn more can click on the links as Reliance share price target 2025, NTPC share price target 2025, Kritika wires share price target 2025, Eicher Motors share price target 2025, Asian Paints share price target 2025, etc.