Dear Readers, Today we will learn about Asian Paints share price, Asian Paints company, Asian Paints history, Asian Paints fundamental & technical analysis, Asian Paints dividend, etc. Let us start.

About Asian Paints

Before we proceed to Asian Paints share price target 2025 to 2030, we must learn about the company & its business first. Asian Paints was founded in the year 1942 by Mr. Champaklal Choksey, Mr. Chimanlal Choksi, Mr. Suryakant Dani, and Mr. Arvind Vakil. Asian Paints headquarters are situated in Mumbai, Maharashtra. The company’s manufacturing operations are across 15 countries with more than 25 manufacturing facilities and is a worldwide supplier of paints. Asian Paints is the leading paint manufacturer in India. Asian Paints is into manufacturing of Chemicals, Coatings, Industrial finishing products, and Decorative paints. The company has more than 7000 employees on its rolls.

The NSE symbol of Asian Paints is ” ASIANPAINT” and the BSE symbol is “50082”. The company is also the holding company of Berger International.

Table of Contents

Technical Analysis – Asian Paints share price

To learn about the share price movement and the future or past rises and falls in a share, one must know how to read the technical charts. Here we will learn about the share price action of Asian Paints over a period of nine long years on a monthly time frame. Let us study the chart.

The starting point of the study of this chart is the 1st January candle with a high of Rs 922.5. The price is sideways from this month and retests the same high in four months’ time. Again this level gets rejected and the price moves into the consolidation zone. This is marked as the first yellow box. The breakout of this zone came in the month of May 2016. From here on, the price reached a high of Rs 1227.3 but couldn’t sustain this level. It again retracted to the previous breakout level which acts as the support zone at this moment.

These two candles touching the support zone are in the month of December 2016 and January 2017. The sideways trend continued for the next 15 months as shown by the second yellow box. The breakout of the level of Rs 1227.3 was achieved in the month of May 2018 and it reached a level of Rs 1490 within the next two months. The price reached a high of Rs 1834 after the breakout of Rs 1490 level in the month of July 2019. The price again consolidated for a few more months and it kept on retesting at this level of 1490 as a support zone for the next many months.

The breakout of this level was achieved in August 2020. Once the breakout came, the price reached a high of 2851(Red candle) within five months time. As you can see, it retracted but showed strength as it broke out of this level of 2851(green candle) within four months. Post this breakout, the high achieved is Rs 3590 but is in the consolidation zone. Till today, it is in the same zone and the box has a big range of approximately 1000 points(large yellow box). Once the price makes a decisive move, either upwards or downwards, we need to wait and watch.

The second observation one can also make is that the price hardly moves below the 20 ema. Even if it moves downward, it moves up this support line as early as possible. This indicator can also be used for your analysis of other stocks as well. I hope the readers would have learned something out of this chart reading.

Fundamental Study – Asian Paints

The market cap of Asian Paints is more than Rs 2.95 lac crores at the current market price of Rs 3076. The price-to-earnings ratio is 58 which is on the higher side. The 52-week high and low of Asian Paints share price is Rs 3568 & Rs 2686 respectively. The ROCE and ROE delivered by Asian Paints are 34% & 27.5% respectively. The book value currently is Rs 173. The stock is trading at more than 17.5 times the book value. The main competitors of Asian Paints are Berger Paints, Indigo Paints, Kansai Nerolac, Akzo Nobel, Shalimar Paints, etc. The revenue of Asian Paints was Rs 34489 cr in the year ending March 2023.

The net profit earned by the company at that time was Rs 4195cr. Asian Paints has delivered a compounded sales growth of 13% over the decade and a stock price CAGR of 20% in the same period. Asian Paints share price has been a wealth generator for its investors. The current inventory days of Asian Paints are on the higher side, i.e., at 121 days. The debtor days have also increased to 49 in March 2023. These are worrying signs for Asian Paints. These may impact the share price to remain sideways or correct little but in the long run, we believe it will give good returns.

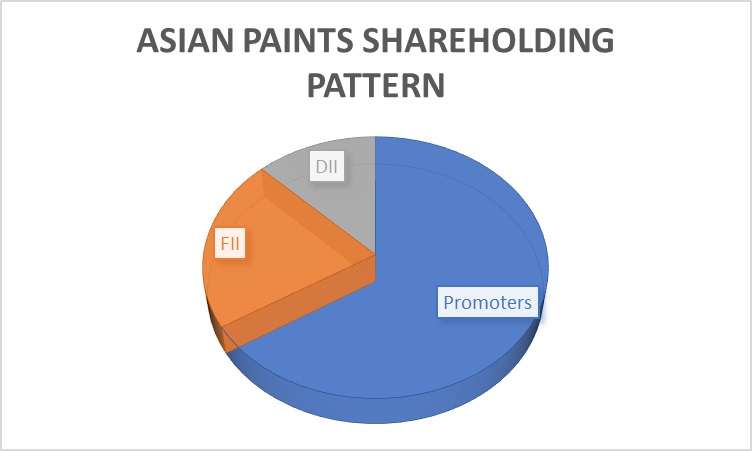

Asian Paints shareholding pattern

The promoters hold 52.63% shares of Asian Paints. The promoter shareholding has been constant over the last three years. The FIIs shareholding has decreased from 20.38% in 2021 to 17.02% in the year 2023. This is a decrease of 12% in the last two years. The DIIs holding in the year 2023 is at 9.96% which is 32% up from the 7.27% holding percentage of the year 2021.

Asian Paints share price history

The table below contains the OHLC(Open, High, Low, Close) share price data on a monthly time frame for Asian Paints share price. You can check this data on the website nseindia.

| Date | OPEN | HIGH | LOW | CLOSE |

| 01-Nov-23 | 2,997.95 | 3,008.90 | 2,930.00 | 2,934.55 |

| 31-Oct-23 | 2,969.00 | 3,012.75 | 2,966.00 | 2,995.70 |

| 28-Sep-23 | 3,281.80 | 3,289.00 | 3,155.00 | 3,301.80 |

| 01-Sep-23 | 3,241.10 | 3,264.20 | 3,217.10 | 3,259.55 |

| 31-Aug-23 | 3,300.05 | 3,302.00 | 3,220.00 | 3,256.10 |

| 01-Aug-23 | 3,372.00 | 3,385.00 | 3,338.00 | 3,342.95 |

| 31-Jul-23 | 3,323.20 | 3,388.00 | 3,323.15 | 3,377.35 |

| 03-Jul-23 | 3,365.00 | 3,379.95 | 3,337.20 | 3,358.70 |

| 30-Jun-23 | 3,353.00 | 3,449.60 | 3,343.75 | 3,362.05 |

| 01-Jun-23 | 3,235.35 | 3,249.90 | 3,207.00 | 3,240.70 |

| 31-May-23 | 3,151.95 | 3,219.35 | 3,136.45 | 3,192.95 |

| 02-May-23 | 2,910.95 | 2,933.70 | 2,893.00 | 2,899.55 |

| 28-Apr-23 | 2,919.95 | 2,919.95 | 2,846.60 | 2,902.35 |

| 03-Apr-23 | 2,746.95 | 2,781.65 | 2,708.65 | 2,777.00 |

| 31-Mar-23 | 2,756.05 | 2,775.00 | 2,747.50 | 2,761.65 |

| 01-Mar-23 | 2,828.00 | 2,853.30 | 2,816.05 | 2,840.90 |

| 28-Feb-23 | 2,750.00 | 2,839.00 | 2,727.45 | 2,828.80 |

| 01-Feb-23 | 2,749.80 | 2,778.00 | 2,704.80 | 2,743.75 |

| 31-Jan-23 | 2,760.00 | 2,779.95 | 2,718.05 | 2,725.85 |

| 02-Jan-23 | 3,087.90 | 3,087.90 | 3,021.00 | 3,047.25 |

| 30-Dec-22 | 3,130.75 | 3,130.75 | 3,071.30 | 3,087.90 |

| 01-Dec-22 | 3,191.00 | 3,197.00 | 3,161.25 | 3,179.35 |

| 30-Nov-22 | 3,139.90 | 3,199.95 | 3,133.30 | 3,175.15 |

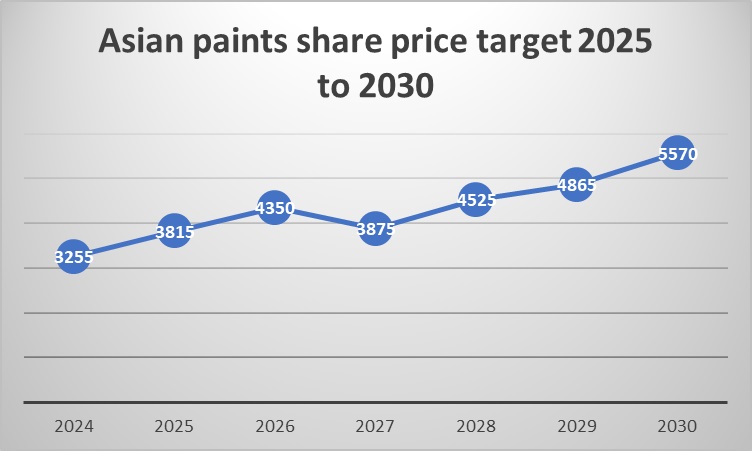

Asian Paints share price target 2025 to 2030

The derived Asian Paints share price target 2025 to 2030 is done based on our limited knowledge and experience in the share market spanning over a decade now. These are only speculated targets which may or may not be achieved. Readers are advised not to make any investments based on these targets and are requested to speak to their financial advisors before making any decision.

Asian Paints share price target for the year 2026 is Rs 4350 & the Asian Paints share price target 2028 is Rs 4525. Please note that the prices of paints are dependent on crude prices. So the investors are advised to keep track of both the paint market as well as the crude oil so that they can see the inverse relation between these two. Readers who wish to read more about Reliance Industries for Oil data and other factors affecting it, pls click here.

What is Asian Paints share price target 2025?

The share price of Asian Paints may reach Rs 3815 by the year 2025.

What is Asian Paints share price history?

Readers may check the history of Asian Paints share price by visiting the website nseindia. The last 52 week’s history is also given in this blog.

What is Asian Paints share price target 2030?

The Asian Paints share price may reach Rs 5570 by the year 2030.

How to check Asian Paints share price today?

The readers can check Asian Paints share price today by visiting websites like nseindia, tradingview, etc.

How to check Asian Paints share price tomorrow?

Readers may derive or speculate the Asian Paints share price target tomorrow by checking the options chain, technical chart reading, volume, candlestick pattern, etc.

What is current share price of Asian Paints?

The current or live Asian Paints share price can be checked on the websites like nseindia, moneycontrol, etc.

How to check Asian Paints share price chart?

Readers can check Asian Paints share price chart on the websites like chartink, tradingview, etc.

How to trade Asian Paints shares?

Readers should open a de-mat account with any of the known brokerages such as Upstox, Motilal Oswal, Kotak Securities, HDFC Securities, etc. After opening the account, readers can trade in Asian Paints shares on the Indian indexes.

Disclaimer

The above blog post is for educational purposes only. This blog post shall not be treated as a piece of investment advice. The readers are advised to speak to their financial advisors before making financial decisions for their investments. The readers are advised to read and learn more about the share markets to refine their edge. We are not SEBI-registered analysts. The above blog post is based on our study of the fundamental and technical analysis of the stock from our past decade-long learnings. Readers who wish to learn more, pls check the below mentioned links:

- BPCL share price target 2025

- ONGC share price target 2025

- Suzlon share price target 2025

- Yes bank share price target 2025

- IRB Infra share price target 2025

- Pidilite share price target 2025

- Tata Motors share price target 2025

- Kritika wires share price target 2025

- Dixon share price target 2025

- TCS share price target 2025