Dear Folks, In today’s blog post, we will learn about the IEX share price target 2025 to the IEX share price target 2030. This blog post will also be covering about the company, IEX, its fundamentals, and its technical aspects

About IEX

Before we learn about the IEX share price target 2025, we will learn about the company. Indian Energy Exchange or IEX is an electronic system-based power trading exchange. It’s regulated by CERC ( Central Electricity Regulatory Commission ).

IEX provides an electronic platform to State Electricity Boards, Power producers, traders, and Access consumers. It provides it to both industrial and commercial consumers. IEX was founded in the year 2008 and has a subsidiary named Indian Gas Exchange. It is into the trading of future and spot contracts of Gas. IGX has a shareholding of NSE, ONGC, Adani Gas, etc.

To learn more about IEX, you may visit the website.

Table of Contents

Technical Analysis – IEX share price target

The price action, volume, and time action of IEX can be studied from the technical charts, and enrty/exit points can be derived from it.

Let’s study the technical chart of the share price of IEX.

Above is the weekly chart of IEX share price movement taken from the website tradingview.

Point 1 – Let us consider a high point of 24th Feb 2020 at 67.95. A trendline is drawn across the same as a reference. The share price has reached this trendline many times but hasn’t been able to breach it successfully till 23rd November 2020.

Point 2 – The share price has breached 67.95 and closed above it. Post this break-out, the price has touched a high of 130.85, marked as point 3 in the above chart.

Point 3 – The price has moved from 67.95 to 130.85 within 5 months of the break-out. This movement has ensured IEX has given a 92% return to its shareholders within a very short period of time.

Point 4 – Before advancing to point 4, the price has consolidated and tested/retested the levels of 130.85 for many weeks. After 4 months of consolidation, the price has finally started moving again to new highs at point 4. This level is 318.65 achieved on 18th October 2021. So an investor with patience holding the IEX shares from 67.95 levels has almost made 4.5 times return on his investment within 1.5 years of holding IEX shares.

Point 5 – Points 4 and 5 have a high and low of 318.65 & 213.75 respectively. This is a range of 105 points within two candles made in consecutive weeks by the price action in the share price. The IEX share price needs to either break out or break down from this range for the next decisive move. This move occurred on 21st February 2022 when the price gave a breakdown and moved below 213.75.

Point 6 – The level of 181.8 has now become a major resistance for future moves. Until the share price gives a decisive close above this level, no entry should be taken into the stock. This is only for the long-term investors. Short-term traders can look for such levels on daily charts and decide for themselves.

The above description and study of the weekly technical charts of the share price of IEX need to be studied deeply by the learners to understand and implement themselves.

Fundamental Analysis – IEX share price

In this section, we will learn about the Fundamentals of IEX.

IEX has a market capitalization of Rs 11173 cr and has a price-to-earnings ratio of 37. The book value of IEX is 8.8 and the stock is currently trading at 14 times the book value. IEX has an ROCE & ROE of 51.5% and 39.2% respectively. The 52-week high and low of the IEX share price are 164 and 116 respectively.

The concerning signs in IEX are that both the FIIs and DIIs have reduced their shareholdings over the last three years. FIIs have decreased their holdings from 36.8% to 17.8% from the year 2023 to 2021. DIIs have also decreased their shareholding in IEX from the year 2021 to 2023 from 27.9% to 21.3%. Public, i.e., retailers have increased their shareholding from 34.93% to 60.32 % in the last three years.

Let’s look at the sales and profit of IEX:

| (in cr) | Mar-21 | Mar-22 | Mar-23 |

| Sales | 317 | 426 | 401 |

| PBT | 282 | 400 | 389 |

| net profit | 213 | 303 | 293 |

IEX has clocked sales of Rs 401 cr in the year ending March 2023. This is an increase of Rs 84 cr from 2021 but a decrease of Rs 25 cr over 2022. The Net Profit of IEX has also decreased in the last year by Rs 10cr. With the power consumption increasing in India and rural areas being electrified by the companies, this company is expected to do good in the long run.

IEX share price target 2025 to 2030

What does IEX do?

IEX is into providing electronic platforms to state electricity boards and companies.

In which sector does IEX operate?

IEX operates in the power sector.

How is IEX related to IGX?

IGX is a subsidiary of IEX.

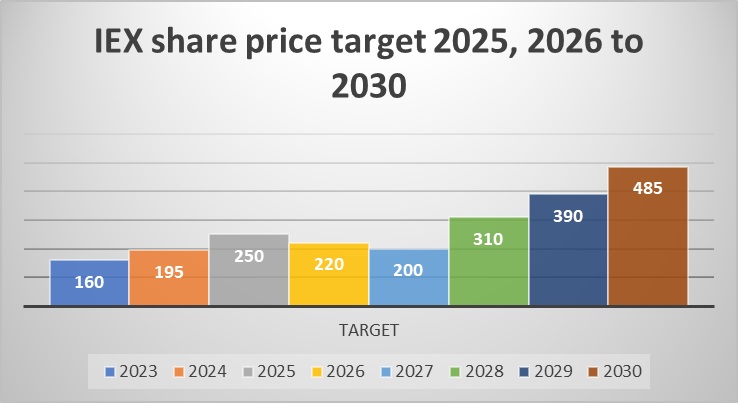

What is IEX share price target 2025?

The share price target of IEX for the year 2025 is expected to be 250.

What is IEX share price target 2026?

The share price target of IEX for the year 2026 is expected to be 220.

What is IEX share price target 2030?

The share price target of IEX for the year 2030 is expected to reach 485.

What is IEX share price today NSE & IEX share price today BSE?

The share price of IEX today can be checked on websites like nseindia.com, tradingview.com, etc.

How to check IEX share price today live chart?

It can be checked on the website tradingview.com.

What is IEX share price target tomorrow?

It can be speculated by checking the charts, option chains, etc.

What is IEX share price target today?

It can be speculated by checking the price and volume action on the charts.

Conclusion

The above blog post is neither a buy nor a sell recommendation to readers. We are not SEBI-registered analysts. The readers are advised to speak to their financial advisors before investing in the stock market as it is subject to market risks. This blog post is only for educational purposes. The readers who wish to learn more please check the links below:

- Tata Motors share price target 2025

- Kritika wires share price target 2025

- Wipro share price target 2025

- Infosys share price target 2025

- Happiest minds share price target 2025

- Titan share price target 2025

- Yes bank share price target 2025

- Axis bank share price target 2025

- IRB Infra share price target 2025

- ITC share price target 2025