Welcome, Dear Friends,

Today we will be learning about one of the most admired IT companies in India, Tata Consultancy Services. We will be looking at the TCS share price target 2025 to TCS share price target 2030 through the lens of Fundamental and Technical analysis of the company.

Table of Contents

About TCS

Before we learn about TCS share price target 2025 to 2030, we will learn about the company. Tata Consultancy Services Limited, fondly known as TCS, is an Indian Information Technology services and consulting company. The headquarters of TCS are in Mumbai, Maharashtra. TCS operates in 46 countries from over 150 locations and has more than 6lacs employees. TCS started its operations in the year 1968 as Tata Computer Services. TCS became a publicly listed company on 25th Aug’2004. TCS is headed by Chairman, Mr.Natarajan Chandrasekaran.

Fundamental Analysis of TCS Share Price 2025 to 2030

TCS commands a market cap of Rs 1226130 cr and currently, The share price of TCS is Rs 3351. The price-to-equity ratio of TCS is 27 and the book value of the share price is Rs 275.

The company has an ROCE and ROE of 58% and 46.5% respectively. The share price of TCS is trading at 12 times the book value. TCS has a dividend payout of 60% and has delivered a 10-year CAGR of 12%, which is excellent for investors. Tata Consultancy Services Limited is a debt-free company.

| P&L consolidated | |||||

| (in cr) | Mar-16 | Mar-18 | Mar-20 | Mar-22 | Mar-23 |

| Sales | 108646 | 123104 | 146463 | 191754 | 225458 |

| Opr profit | 30677 | 32516 | 42109 | 53057 | 59259 |

| net profit | 24338 | 25880 | 32447 | 38449 | 44819 |

TCS revenue has increased by 54% over the last three years and the net profit has increased by 38% during the same period. TCS promoter shareholding has remained constant at 72.3% over the last three years. The shareholding of FIIs has decreased by 18% during this time period. DIIs shareholding has increased from 7.83% to 9.58% over the last three years. Similarly, the public shareholding has increased by 24% during the last three years, i.e., a jump from 4.31% to 5.36%.

TCS share price target – Technical Analysis

Let’s analyze the TCS share price action through the study of weekly and monthly charts. Let’s start with the TCS share price monthly chart.

The share price of TCS was Rs 1372.4 in the month of August 2016. The share price kept on consolidating till the month of Dec 2017. The share price gave a breakout from this range in the month of Jan 2018 and reached Rs 2275.95 in the month of October 2018. As you can see, the TCS share price jumped 64% within 10 months once it came out of the consolidation of 1.5 years. The share price consolidated again from October 2018 till July 2020. In July 2020, the stock closed at Rs 2281, above the resistance price of Rs 2275.95. Post this breakout, the share price reached a high of Rs 3981.75 in Sep 2021. This is a jump of 75% in the share price within 15 months.

So a smart investor needs to wait with lots of patience before deciding to buy or sell the shares. Also, the timing of the same is important. Imagine an investor holding the TCS shares in the consolidation phase and selling them by getting impatient just before the rally. There are many retail investors who lose such rallies by getting impatient due to inaction in the share price for a long time. So it’s important to keep observing the price action and not to lose your patience.

Weekly chart- TCS share price

Now let’s have a look at the weekly chart of TCS share price.

The share price of TCS reached a high of Rs 2275.95 in the month of October 2018. The price remained in the consolidation phase till Feb 2020 and then broke down in March 2020 ( Covid-19).The above chart shows a bearish candle (March 2020). The TCS share price started moving in the zone made by the Feb 2020 and March 2020 candles post the breakdown. As you can see, the price moved within this box and rose to Rs 3989.9 in the month of Oct’21.

So an investor or trader can keep his position till the price remains within the box and can sell off the shares as and when the price breaks down from the bottom of the box. If the price breaks out from the top of the box, then it’s good as it will move further up.

You can practice such analysis on the website.

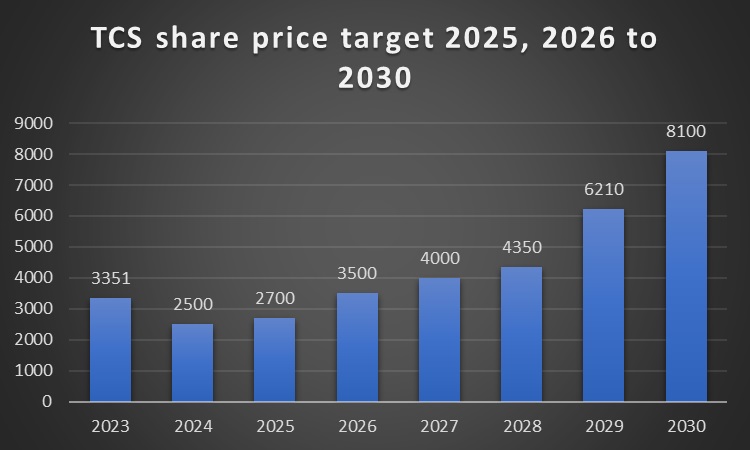

TCS share price target 2025 to 2030

Is TCS a Tata Group company?

Yes, TCS is a Tata Group company.

What is TCS share price target 2026?

TCS share price is expected to be within the range of Rs 2700 to Rs 3500.

In how many countries does TCS operate?

TCS has operations in more than 46 countries.

What is TCS share price target 2025?

The share price target of TCS is Rs 2700 for the year 2025.

Who is the Chairman of TCS?

TCS is headed by Chairman, Mr. Natarajan Chandrasekaran.

What is TCS share price today target?

It can be checked on websites like nseindia.com, tradingview.com, etc.

What is TCS share price history?

You can check TCS share price history on websites like nseindia.com, moneycontrol.com, etc.

How to check TCS share price today chart/graph?

The charts/graphs can be checked on websites like tradingview.com, chartink.com, etc.

Where to check TCS share price today live chart?

It can be checked on the website tradingview.com

What is TCS share price target 2030?

The target for TCS share price for the year 2030 is 8100.

Conclusion

The above blog post is only for educational purposes. It is in no way a buy or sell recommendation. The investors are advised to consult their financial advisors before buying or selling any shares. We are not SEBI registered advisors and the blog post is intended to clarify the ways in which an investor can analyze the share prices. Investors interested to learn more may check the links below:

- Tata Motors share price target 2025

- Maruti Suzuki share price target 2025

- Suzlon share price target 2025

- Infosys share price target 2025

- Happiest minds share price target 2025

- IEX share price target 2025

- Axis bank share price target 2025

- Yes bank share price target 2025

- Bajaj Finance share price target 2025

- Titan share price target 2025